Bank Profile

A Salute to Our Visionary Founders

VISION

To be the preferred choice of stakeholders and deliver value by blending technology with tradition.

MISSION

To provide a superior banking experience by using technology to deliver an entire gamut of financial products under one roof, easily available to customers across physical and digital channels.

At Karur Vysya Bank, we believe true strength is measured by the trust we build and the value we create. As we present our Corporate Profile for 2025, we reflect with pride on a legacy shaped by resilience, innovation and a deep commitment to our customers.

The year has been one of steady progress. Our focus on sound fundamentals, digital transformation and customer-centric solutions has reinforced our position as a trusted partner in financial growth. We continue to draw strength from our heritage while remaining firmly focused on the future.

We are building on strength. We are banking on trust. We are moving forward with purpose and clarity to deliver enduring value for all our stakeholders.

OUR FINANCIAL STRENGTH

KVB continues to deliver consistent financial performance, supported by sound fundamentals and disciplined execution. As of 31st March 2025, the Bank’s total business reached ₹1,86,569 crores, reflecting a 14 percent year-on-year growth.

The deposit base stood at ₹1,02,078 crores, while advances reached ₹84,491 crores. The Bank recorded a net profit of ₹1,942 crores, maintaining its position as a financially strong and efficiently managed institution.

Asset quality remained robust, with net NPA further reduced to 0.20%, reflecting the Bank’s prudent credit practices and effective risk management framework.

Karur Vysya Bank remains committed to leveraging technology, strengthening customer relationships, and expanding its reach across India with accessible and secure banking solutions.

| Particulars (Rs. in crores) | 2022-23 | 2023-24 | 2024-25 |

|---|---|---|---|

| Deposits | 76,638 | 89,113 | 1,02,078 |

| Advances | 64,168 | 74,423 | 84,491 |

| Net Profit | 1,106 | 1,605 | 1,942 |

| Particulars (Rs. in crores) | 2022-23 | 2023-24 | 2024-25 |

|---|---|---|---|

| Owned Funds | 8,584 | 10,040 | 11,929 |

| CRAR | 18.56% | 16.67% | 18.17% |

| Net NPA | 0.74% | 0.40% | 0.20% |

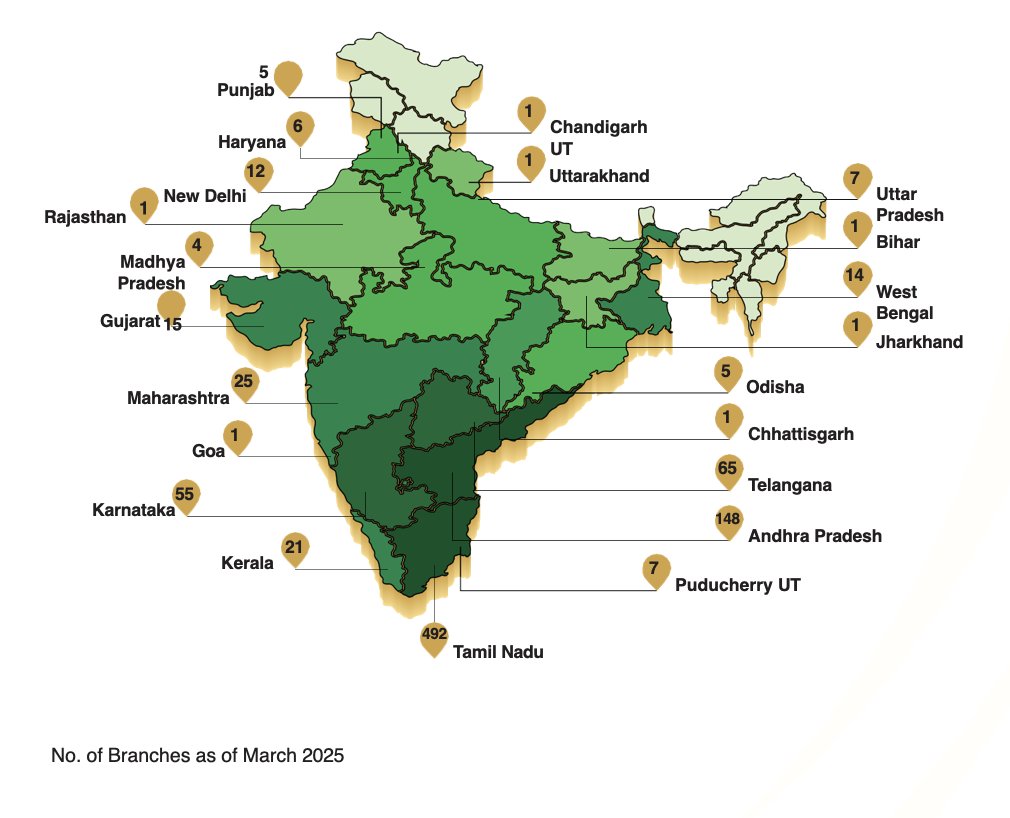

MAKING A PRESENCE

KVB has a pan India presence with a strong presence even in semi-urban and rural locations, with an extensive network of branches, ATMs & Cash Recyclers. Our strategic locations in these key markets anchor our operations and support our nationwide reach. We prioritise accessibility and convenience, ensuring our branches, ATMs, and cash recyclers serve as vital touchpoints for seamless transactions and personalised assistance to our valued customers.

In order to enhance processing efficiency and ensure quick turnaround times in the MSME sector, we operate 14 Business Banking Units and 9 Corporate Banking Units. As we continue to expand, we 888 2,252 45,000+ across across Branches Branches ATM + Cash Recyclers ATM + Cash Recyclers UPI & Sound Box UPI & Sound Box 5 Punjab 1 6 Chandigarh UT Haryana 1 12 Uttarakhand 7 New Delhi 1 Rajasthan 1 4 remain committed to upholding our values of integrity, customer-centricity, and innovation.

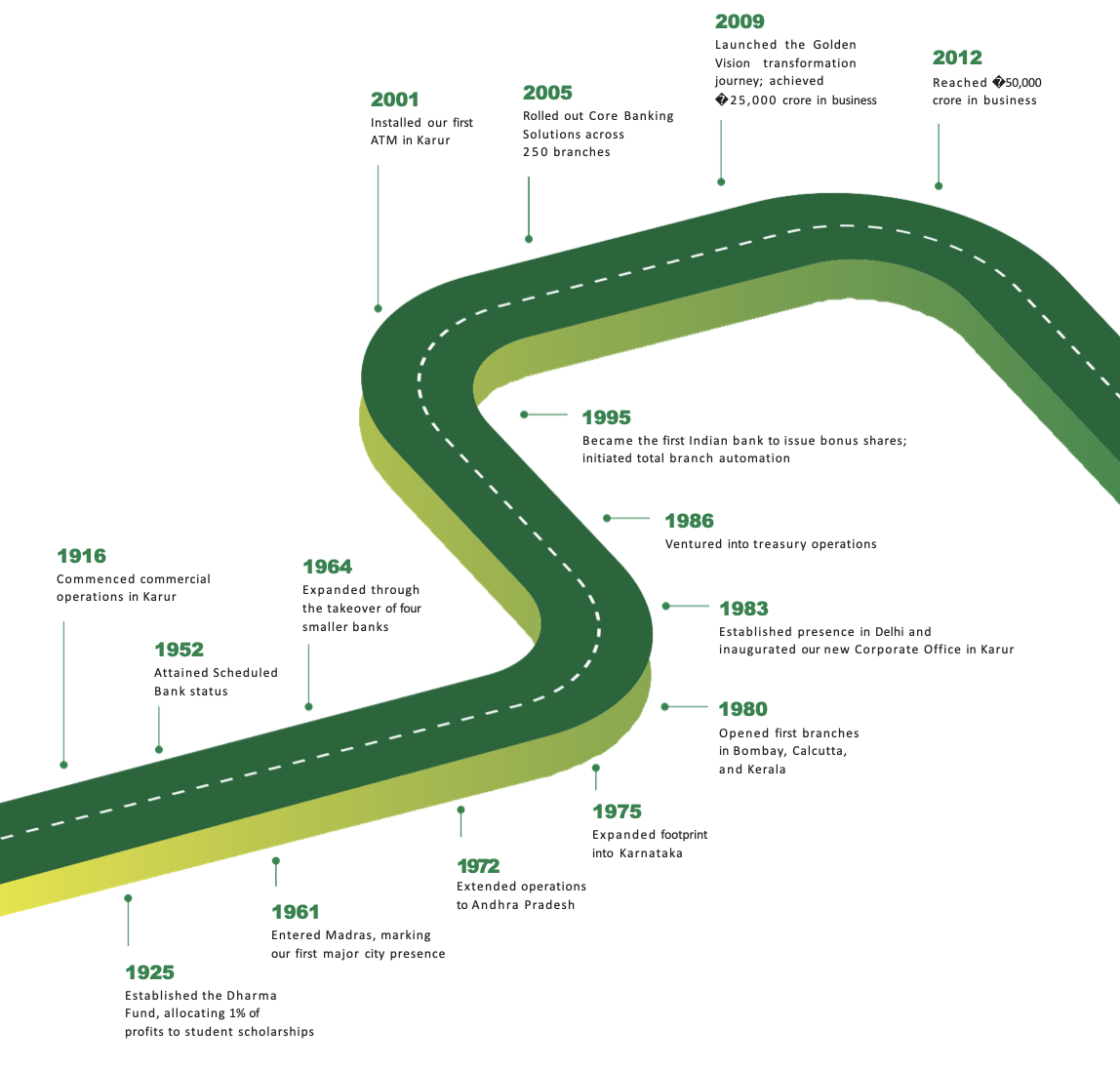

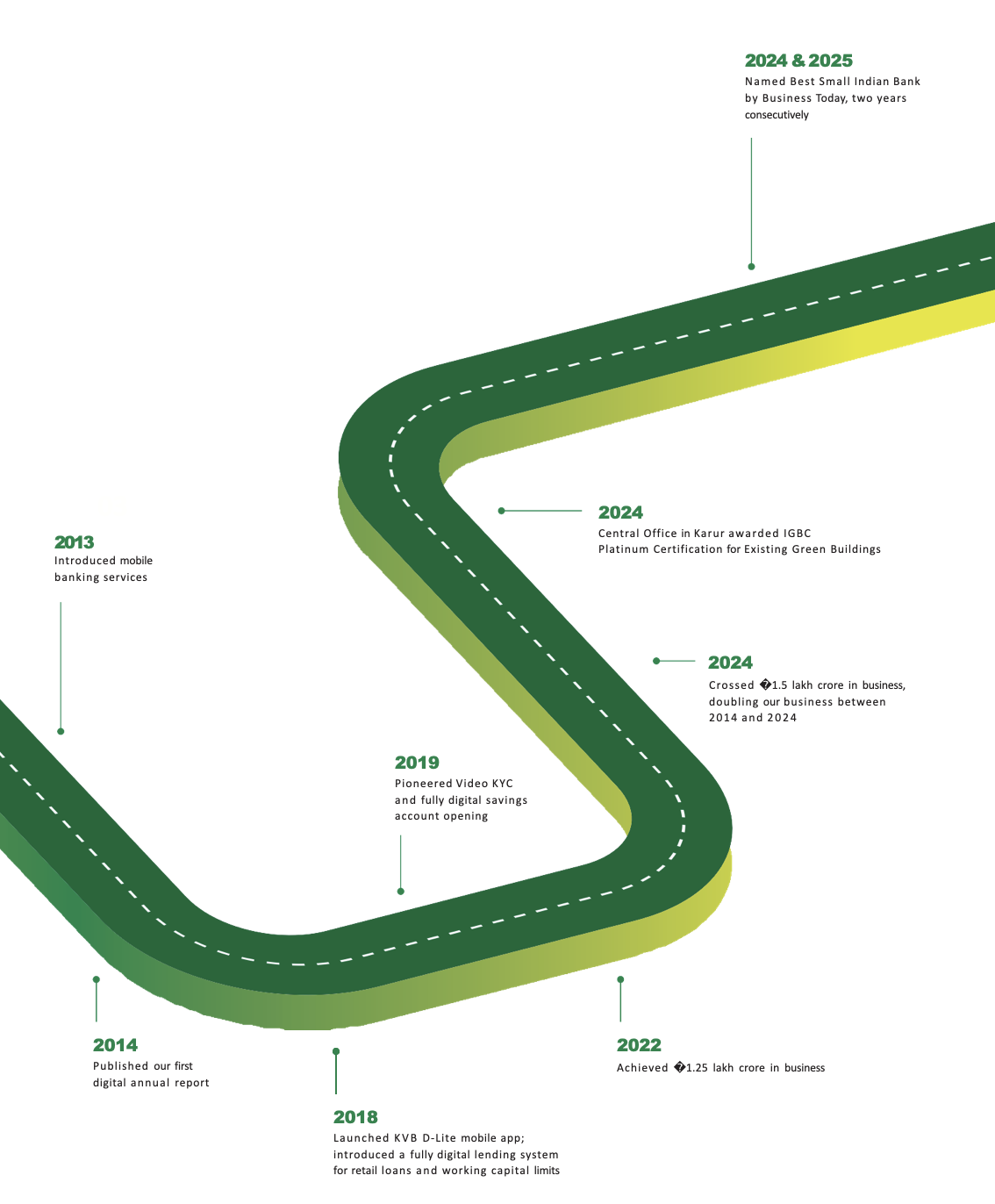

OUR JOURNEY SO FAR

What began in 1916 as a humble initiative in the small town of Karur has grown into one of India’s most respected and trusted financial institutions. Our founders envisioned a bank that would serve communities with integrity, prudence and compassion. Over the decades, that vision has evolved, keeping pace with changing times and expanding horizons. Yet, the core promise remains unchanged, to serve with responsibility and build trust through every interaction.

Milestones That Shaped Our Journey

OUR PRODUCT PORTFOLIO

At KVB, we are cognizant of the unique financial aspirations of our diverse clientele. We deliver a compelling value proposition through a comprehensive suite of best-in-class products and services, continuously enhanced by cutting-edge digital tools and data-driven analytics.

We ensure a seamless customer experience across all touchpoints, fostering long-term trust and empowering financial success. This approach empowers us to gauge evolving financial needs and continuously develop innovative solutions.

Key offerings(Retail Loans)

- Housing Loans

- Personal Loans

- Mortgage Loans

- Four-wheeler Loans

- Two-wheeler Loans

- Gold Loans

- Deposit Loans

- Education Loans

- BNPL Loans

Key offerings(Liabilities)

- Current Account

- Savings Bank Account

- Credit Cards

- FASTag

- Recurring Deposits

- Term Deposits

- NRI Deposits

- 3-in-1 Account with Banking, Demat, and Trading Services

- Life, Health, and General Insurance

- Mutual Fund Products

- Sovereign Gold Bonds

Key offerings(Commercial - Fund Based)

A. Fund-based facilities:

- Working Capital Finance up to Rs. 100 Lakh (based on GST, without audited financial statements)

- MSME Project Loans

- Export Credit Finance

- Machinery Loans

- Mortgage Loans

- Rent Fin Loans

- Commercial Real Estate (CRE) Loans

- Corporate Credit Card

- Bill Discounting

- Commercial Gold Loans

- Commercial Flexi Mobile Vehicle Loans

- Supply Chain Finance - Dealer Finance, Vendor Finance, TReDS, Factoring

- Cash Management Service - API, VA, Collections & Payment Services

B. Non-fund-based facilities:

- Bank Guarantees

- Letters of Credit (ILC/FLC)

Key offerings(Corporate and Institutional)

- Working Capital Finance

- Term Loans

- Specialised Corporate Finance Products

- Liquidity Management Solutions

Key offerings(Agriculture)

- Crop Loans

- Gold Loans

- Dairy Loans

- Fishery Loans

- Poultry Loans

- Horticulture Loans

- Warehouse Receipt Loans

- Agri Infrastructure Loans

- FPO Loans

- Joint Liability Group Loans

FUELING GROWTH THROUGH INNOVATION

At KVB, innovation is not merely an ambition; it is a mindset that shapes how we serve, grow and evolve. We have consistently embraced technology to redefine customer experiences, improve operational efficiency and make banking more accessible. Our digital-first approach ensures that customers enjoy seamless, secure and convenient services across every touchpoint, from mobile to branch. Through KVB DLite, our comprehensive mobile banking platform, we enable over 150 financial and non-financial services, simplifying banking and empowering customers to manage their finances with ease.

We were among the early adopters of end-to-end digital underwriting in retail and MSME lending, bringing greater speed, transparency and efficiency to credit delivery. This commitment to innovation extends across our ecosystem through robust digital payment solutions, automated onboarding journeys and agile platforms designed to serve the evolving needs of individuals, SMEs and corporates alike.

Internet Banking

End-to-end digital underwriting for retail and MSME loans

Pre-Approved Offers

Instant personal loans, credit cards and Buy Now Pay Later

Digital Banking

Over 150 services through KVB DLite mobile banking

Payments

Bharat QR, BHIM Aadhaar Pay, FASTag, POS, BBPS integration

Self-Service Solutions

Digital onboarding, deposits, transactions via mobile and web

Technology Adoption

AI, automation and analytics driving efficiency and security

BOARD OF DIRECTORS

Under their leadership, KVB has achieved remarkable milestones, including a 14% year-on-year growth in total business to ₹1.86 lakh crore as of March 2025, and highest net profit of ₹1,942 crore for the year ended 31.3.2025. The leadership's commitment to innovation and prudent risk management continues to position KVB as a resilient and forward-thinking institution in India's banking sector.

Dr. Meena Hemchandra

Non-Executive Independent (part-time) Chairperson

Shri B Ramesh Babu

Managing Director and Chief Executive Officer

Shri Sankar Balabhadrapatruni

Executive Director

Shri R Ramkumar

Non-Executive Non-Independent Director

Dr. R Harshavardhan

Non-Executive Independent Director

Shri Murali Ramaswami

Non-Executive Independent Director

CA Dr. Chinnasamy Ganesan

Non-Executive Independent Director

Smt. Srimathy Sridhar

Non-Executive Independent Director

Dr Mythili Vutukuru

Additional Director under Independent Category

Shri R Vidhya Shankar

Non-Executive Independent Director

ACCOLADES

Best Small Indian Bank

Business Today - 2024

Best Small Indian Bank

Business Today - 2025

100+ Awards. Built on 109 Years of Legacy.

OUR COMMITMENT TO THE COMMUNITY

We believe banking is not just about numbers, it’s about nurturing lives and communities. Our commitment to Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) principles reflects our purpose: building a better, inclusive, and sustainable tomorrow.

In FY 2024–25, KVB initiated 47 impactful CSR projects across Tamil Nadu, Kerala, Andhra Pradesh, Karnataka, Haryana, and Telangana, spanning healthcare, education, environment, livelihood, and more. These initiatives have positively touched the lives of 1,60,621 individuals, driving meaningful change and fostering community well-being across these regions.

Education & Skill Development

- KVB Scholarship Programme:

- Financial aid for 100 economically disadvantaged students across Tamil Nadu, Andhra Pradesh, and Telangana.

- Cybersecurity & Financial Literacy:

- Awareness drives via digital media, radio, and roadshows in Trichy, Karur, and Madurai.

- Mini Science Centres:

- 35 STEM labs set up in rural government schools across Tamil Nadu.

- Support for Sports:

- Financial sponsorship for national-level weightlifter Mr. Dhanush Loganathan.

- Women Skill Training:

- 180 rural women trained in palm jaggery & seashell crafts.

- Hydroponics training for 90 villagers in Tiruvallur.

- Skill centre in Coimbatore trained 400 women/youth with placement support.

- 400 women entrepreneurs supported via Primary Producers Groups in handicrafts, tailoring, and embroidery.

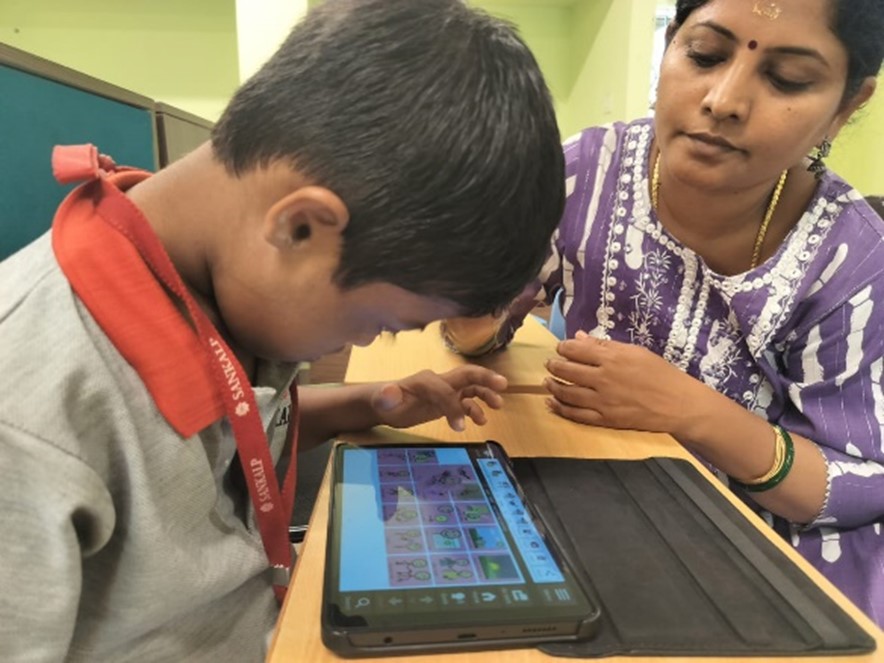

- Special Needs Support:

- Tools, therapy, and vocational training for 90+ special-needs children.

- Financial Inclusion:

- 302 campaigns held, reaching 4,099 people across rural, semi-urban, and urban areas.

Health, Hygiene & Sanitation

- School Sanitation:

- Improved facilities in 15 government schools.

- Conducted Wash and Menstrual Hygiene training.

- Migrant Childcare:

- Support for children of migrant labourers focusing on early education and nutrition.

- Spine & Limb Surgery:

- In partnership with Ganga Spine Injury Foundation.

- Free Dialysis:

- Support for 14-bed dialysis unit under Project Asha Kiran in Bengaluru.

- Reconstructive Surgery:

- Support for patients with congenital or accident-related deformities.

- Cancer Treatment:

- Aid for stage II & III cancer patients from low-income groups.

- Medical Equipment Support:

- Provided to multiple government hospitals and health centres across Tamil Nadu and Andhra Pradesh.

- Ambulances:

- Donated for elderly care and rural outreach (e.g. Melmaruvathur, Chennai).

- Ophthalmic Care:

- Donated equipment benefiting 3,000+ patients.

- Supported Sankara Eye Hospital.

- Healthcare Access:

- Ambulance support for rural medical camps.

- Support for Children with Cerebral Palsy:

- Early intervention and home-based care for 65 children.

- Burn Survivor Support:

- Reconstructive surgery for post-burn deformities.

- Primary Health Centres Renovation:

- Upgraded 5 flood-affected centres with Bharat Cares.

Environment & Sustainability

- Walk N Jog Park:

- Maintained public space with greenery and fountains in Karur.

- Dryland Agriculture:

- Climate-resilient farming support in Virudhunagar covering 3,013 households.

- Urban Forestry:

- Planted 10,000 native trees in Chennai.

- Village Forest:

- Planted 1,200 trees in 2.25 acres in Karur.

- Stormwater Drain Renovation:

- Work carried out at Aadhi Kumbeshwarar Temple.

- Solar Water Heating:

- Installed systems at 3 hostels of Mother Teresa Women’s University, Kodaikanal.

- Waste Management:

- Donated electric garbage vehicles.

- Collaborated with IIT Madras Incubation Cell on safe sanitation technology.

- Wind Powered Electricity:

- The Central Office is powered through an 850 KW Wind Turbine Generator owned by the bank at Theni.

- This windmill also powers the Divisional Office in Chennai.

Additional Initiatives

- Support for 90+ special-needs children

- Hydroponics training for 90 villagers (Tiruvallur)

- 400 women entrepreneurs via Primary Producers Groups

- Support for children with cerebral palsy – 65 children

- Burn survivor support with reconstructive surgery

- Stormwater drain renovation at Aadhi Kumbeshwarar Temple

FUTURE OUTLOOK

KVB enters the next phase of its journey with a clear strategy and strong fundamentals. The Bank continues to uphold the principles of sound risk management and corporate governance while accelerating its focus on digital transformation and customer-centric innovation.

With consistent year-on-year business growth and robust financial indicators, the Bank is well-positioned to navigate an evolving economic landscape. Its digital-first approach, combined with a legacy of trust, enables it to deliver reliable, accessible, and secure banking experiences.

Going forward, KVB aims to:

- Enhance digital capabilities across retail, MSME, and corporate banking

- Expand its reach in semi-urban and rural markets with scalable products

- Strengthen asset quality and capital position through prudent management

- Promote sustainability through ESG-aligned initiatives and reporting

- Drive innovation through AI, automation, and data analytics

KVB will continue to deliver value through technology-enabled services while staying true to its core values. The focus remains on building long-term relationships with customers and contributing to inclusive and sustainable financial growth.

The Bank moves ahead with clarity and purpose, committed to strengthening its legacy and reinforcing its position as a trusted, forward-looking financial institution.